- The Host Report Newsletter

- Posts

- Vacation Rental News & Insights

Vacation Rental News & Insights

Predictions for 2026

Good morning,

Here’s what’s going on in the vacation rental world this week:

New data shows direct bookings jumped 91% in 2025 as hosts worked to cut fees, the World Cup match schedule triggered a surge of reservations across North America, and Airbnb tightened its New Year’s Eve anti-party system ahead of the holiday.

New York City’s attempt to reopen its STR market fell apart, Las Vegas cannot enforce its licensing and fine structure after a federal ruling, and Lisbon scrapped its 2019 STR restrictions after data shows they drove prices higher instead of improving affordability.

Lets dive in.

NEWS

Headline Roundup

A data-driven look at how 2025 reshaped the STR market (The Host Report)

Direct bookings jump 91% as hosts push to cut fees (The Host Report)

Airbnb's NYC comeback stalls after bill to ease restrictions hits a wall (Bloomberg)

World Cup Schedule Triggers Massive Booking Spike Across North America (The Host Report)

Airdna’s U.S. market review for November 2025 (AirDNA)

Airbnb tightens New Year’s Eve anti-party screening (The Host Report)

Atlas VMS launches a STR appraisal form designed to help lenders accurately evaluate STR properties (MortgageOrb)

AAA projects 122 million Americans will travel for the holidays, setting another record (AAA)

Expedia buys Tiqets to accelerate its one-stop travel platform strategy with activities and experiences (Expedia Group)

Exclusive Collective moves to buy Inspirato for $59M, uniting three luxury travel brands: Exclusive Resorts, Inspirato, and Onefinestay (Business Wire)

190 Sonder properties up for leasehold interest after company bankruptcy (Hotel Dive)

StayTerra expands in Florida with Cape and Coast investment (Business Wire)

INTERESTING INSIGHTS

Predictions for 2026:

1) The Airbnb search bar will go away

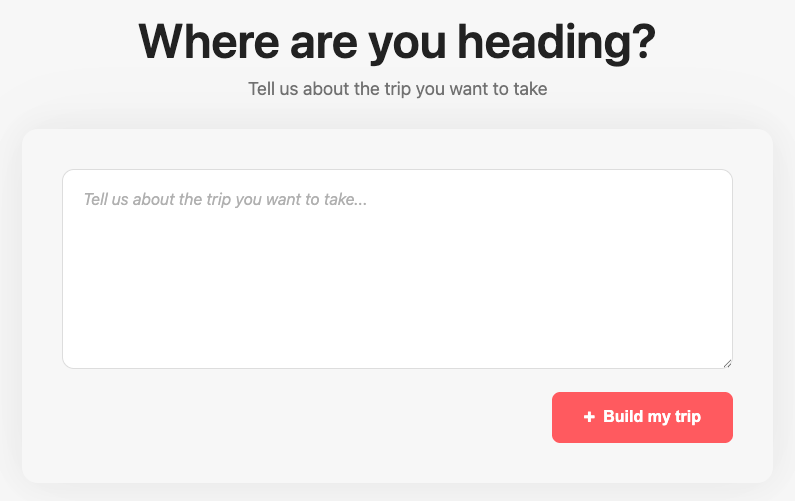

I predict that next year will have a big shift in how guests search for properties. The search bar that asks guest to “select city, dates, and number of people” will go away.

And Airbnb’s search bar next year will evolve to look more like this:

A guest will type something like:

“Im traveling to Miami with 3 friends for the Jonas Brothers concert on July 12th. We want to have a house with a pool and be walking distance from the ocean. It’s important for us that everyone has their own bed. One of my friends is really into wellness, so a sauna would be nice.”

Then, Airbnb will present the guest with a short list of 3-5 properties that fit their description.

In addition to guest convenience (they don’t have to hunt to find the right property), this will let Airbnb push their new Experiences and Services businesses, and essentially provide a full trip recommendation: “This is where you should stay. You should do this jet ski experience before the concert. Then, you’ll probably want this private chef service the next day.”

2) Elite Airbnb operators will move out of residential real estate

I predict that top-tier hosts will move out of residential real estate, and into commercial real estate like Boutique Hotels, Micro Resorts, or Glamping Resorts. Here’s why:

The top STR operators have already mastered the fundamentals that make a boutique hotel successful:

Guest experience design - Top hosts obsess over reviews, amenities, and the guest journey

Dynamic pricing - Many operators are more sophisticated with revenue management than legacy hotel operators

Digital marketing - Hosts understand direct booking funnels, social media, and online reputation management

Operational efficiency - Successful multi-property Airbnb operators already manage cleaning teams, maintenance workflows, capex budgets, and software stacks

The truth is, many traditional hotels are worse at hospitality than top-tier Airbnb operators. They're stuck in outdated service models while STR hosts have been forced to innovate.

Regulatory Certainty Is a Huge Advantage

Airbnb regulations are increasing and volatile in just about every market. It's exhausting for STR operators to constantly navigate gray areas while fighting city councils and the NIMBY crowd. There are still plenty of good Airbnb markets, but the number is shrinking.

Micro resorts aren't threatened by sudden STR bans or 30-day minimum requirements. Hotel zoning offers predictability that allows you to plan a 10-year strategy without wondering if your business model will be legal next year.

Income-Based Valuation Works In Your Favor

Airbnb’s are valued on comps. Let's say you have an Airbnb that's absolutely crushing it, making 25%+ cash-on-cash returns. What happens when you go to sell? In most cases, that Airbnb property is valued based on what the house across the street sold for. Successful Airbnbs generate amazing cashflows, but your operational excellence doesn't always translate to a higher sale price.

Boutique hotels are different. They are valued based on the income approach. And there are more profit levers you can pull to increase NOI: weddings, corporate retreats, in-house restaurants and bars, co-working spaces, spa services, top-tier amenities, curated experiences.

If a smart operator adds $100K to a boutique hotel's NOI and the property later sells at an 8% cap rate, that operator added $1.25 million to the hotel's value. That's massive.

To be clear: I 100% believe vacation rentals are one of the absolute best ways to build generational wealth, and I shout that from the rooftops every day. I’m just saying that top-tier Airbnb operators have an excellent foundation to make the leap into larger commercial real estate projects if that's what they want to do, and I predict many will.

3) Massive surge in direct bookings, ”drive-to” destinations, and “off the beaten path” destinations

We saw these trends pick up in 2025, but I expect it to really accelerate in 2026.

It all boils down to affordability. Shorter booking windows (travelers waiting longer to book their stay), a shift from “week-long” stays to “long weekends”, and “drive-to” instead of “fly-to” destinations all are a result of people being less confident in their financial situation.

To be clear, I actually think 2026 will be a great year for the economy, but a strong economy doesn't mean people feel rich. High net-worth and luxury travelers will be unaffected, but I expect middle class and even upper middle class travelers to make these tweaks. They’ll still go on vacation, but they’ll be looking to get more bang for their buck.

Direct bookings will increase:

This year I noticed a trend of articles in places like Yahoo that coached guests on how to do things like reverse image search an Airbnb’s listing photos to find the Airbnb’s direct booking site to save the 15% fees. This is interesting because normally hosts have to go out and market their properties to drive direct bookings - but this trend means that guests are using Airbnb as a discovery platform, but then actively searching for direct booking channels to save money.

I also believe that hosts will continue to push to capture guest contact information, and remarket to drive repeat bookings.

More “off the beaten path” destinations:

Vrbo recently published a really interesting article noting increased demand in several “emerging” ski regions (not your typical Lake Tahoe/Park City/Vail ski slopes). They were seeing demand grow in smaller and lesser-known ski regions across North Carolina, Utah, New Hampshire, Pennsylvania, and Oregon, where lower nightly rates and lift costs appeal to price-sensitive travelers.

I predict this trend applies beyond just for skiing and we will see a surge in secondary destinations that have a similar “vibe” as more of the middle class gets priced out of top-tier areas.

4) Niche experiences will create ultra successful vacation rentals in 2026

I predict that the next wave of breakout listings will share two traits:

Niche Experiences

Ultra successful Airbnbs will be experienced based and community based. Properties will be tailored to specific groups that want a specific experience (ex: guys on a golf trip). The property will deliver such an amazing experience that it creates raving fans who can't wait to tell their friends about it.

Excellent Direct Marketing Strategies

These hosts will ditch dependency on Airbnb. Instead, they’ll run niche-targeted ads, drive traffic to their direct booking sites, and build email lists for re-engagement. Platform fees go down, while control, profit margins and occupancy rates go up.

The key insight here is that unique experiences give hosts pricing power. They let you escape the race-to-the-bottom dynamics of crowded Airbnb search results.

My favorite example of this is Birdie Houses:

What makes it work:

Experience-first amenities: On-site golf simulators, putting greens, short game practice areas, an outdoor bar, barrel sauna, and golf-themed decor throughout.

Direct booking machine: 94% of reservations come direct, driven by 110K+ Instagram followers and a great content strategy.

Clear niche positioning: Every detail, from marketing language to design choices, speaks specifically to golfers. (When booking, they don’t ask for the number of “guests” - they ask for the number of “golfers.” That’s the level of specificity I’m talking about.)

Cheers to a great 2026!!

MARKET INSIGHTS

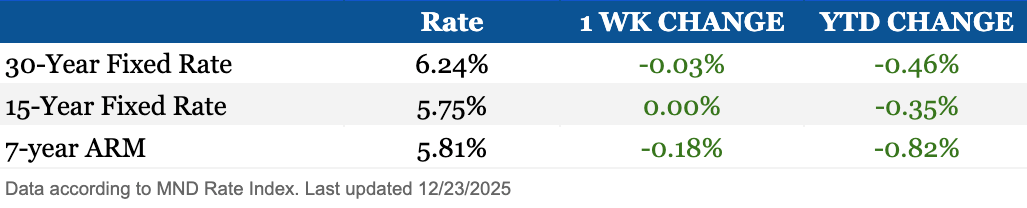

Mortgage Rate Snapshot

Mortgage rates barely moved this week, briefly reacting to softer inflation and stronger GDP data before holiday trading pulled them back into the same tight range.

Regulations Update

New York City's legislative attempt to ease strict host-presence requirements and registration mandates failed, leaving the effective ban on most short-term rentals intact in one of the country's largest potential markets.

Las Vegas, Nevada, was blocked by federal court from enforcing STR licensing requirements, daily fines, and nuisance declarations after a judge found the county's system likely violates constitutional due process due to slow processing times and enforcement against pending applicants.

Lisbon reversed its 2019 short-term rental restrictions after they failed to improve housing affordability and instead accelerated price growth, now allowing STRs to comprise up to 10% of local housing supply.

See this weeks full regulations report here: (The Host Report)