- The Host Report Newsletter

- Posts

- Vacation Rental News & Insights

Vacation Rental News & Insights

The biggest STR trends of 2025

Good morning,

Here’s what’s going on in the vacation rental world this week:

HomeAway is taking Michigan to court over an $18.7 million tax dispute, AI-powered trip planning is quickly becoming hospitality’s next major booking funnel, and we look back on the biggest STR trends that shaped 2025.

Lets dive in.

NEWS

Headline Roundup

HomeAway sues Michigan over $18.7 million tax bill (The Host Report)

AI-driven trip planning is emerging as hospitality’s next major booking funnel (Hospitality Tech)

Can Airbnb work for hotels? What early tests show (Skift)

Former pilot converts an airplane into a luxury Airbnb (AS USA)

CNBC’s top five travel trends for 2026 (CNBC)

New Denver luxury travel collective takes shape after Inspirato’s acquisition (Denver Business Journal)

Prism, parent of OYO, secures approval to raise $742 million through an IPO (Reuters)

Listings with Twilight or Golden Hour Photos:

Get up to 3x more clicks compared to standard daytime shots

Receive 60% more views online, and can generate up to 42% higher click-through rates

INTERESTING INSIGHTS

The Biggest STR Trends of 2025

Major market shifts

In 2025, major moves in policy, pricing, and guest behavior pushed the industry into a new cycle, and operators had to adjust fast.

Trade wars and new tariffs added volatility. We saw a drop off in searches from international travelers for U.S. stays fall by over 50% in March and April.

The U.S. restored 100% bonus depreciation, which made STRs more appealing for high earners looking to reduce taxes.

The Federal Reserve began a new rate cutting cycle by cutting interest rates, and we saw a slight drop mortgage rates through the course of the year.

General economic uncertainty throughout the year had several downstream impacts. We saw:

Direct bookings increase as hosts pushed to cut OTA fees and guests are looking for value.

High-income travelers are still booking without hesitation, but the average guest is waiting longer to commit and hunting for value, resulting in shorter booking windows across all major platforms.

Winners and Losers in Property Management

Casago’s acquisition of Vacasa’s management portfolio for $130 million was the most talked about story in property management. The deal transferred roughly 38,000 homes and closed the chapter on Vacasa, a company that had raised more than $630 million and gone public at a $4.5 billion valuation before collapsing.

The lesson was clear, local operators with control of their own P&L were performing better than companies trying to manage everything from a corporate office.

Several other well-known operators struggled. Sonder went bankrupt. Roami filed for bankruptcy. Homelike shut down. And HomeToGo moved forward with its acquisition of Interhome.

Airbnb Platform Changes

Airbnb made more platform changes in 2025 than in any recent year.

It began the year by removing over 400,000 low-quality listings to improve quality across the platform.

Then, Airbnb launched a strict Off-Platform Policy that banned hosts from asking for guest contact information, required all mandatory fees to be listed in Airbnb’s pricing, pushed upsells into Airbnb’s checkout flow, and required property access that does not rely on mandatory third-party apps.

The Summer Release completely redesigned the Airbnb app, added Services in more than 100 cities, and relaunched Experiences across 650 cities.

Later in the year, Airbnb removed hosts ability to select a “Strict” cancellation policy, added Reserve Now Pay Later feature, shifted to the “Host only fee” model, and opened the platform to hotel listings.

Whew. Thats a lot of changes.

New Tech and Major Funding Rounds

AI grew from an emerging trend to the new standard for STRs. Nearly every PMS, revenue management system, and guest operations platform launched AI-driven tools. Guest messaging automation and revenue optimization were the two most common use cases.

The sector also saw consistent venture funding:

The standout was Hostaway’s $365 million private equity round, pushing the company to a $1 billion valuation - the first PMS unicorn in the STR space.

Other notable raises included:

Gathern, $72 million

Wander, $50 million

Holidu, €46 million

Kasa, $40 million

Arbio, $36 million

Steadily, $30 million Series C

Apaleo, €20 million Series B

Boom, $12.7 million

Conduit, $3.1 million dollar seed

SuiteOp, $3 million dollar seed

MARKET INSIGHTS

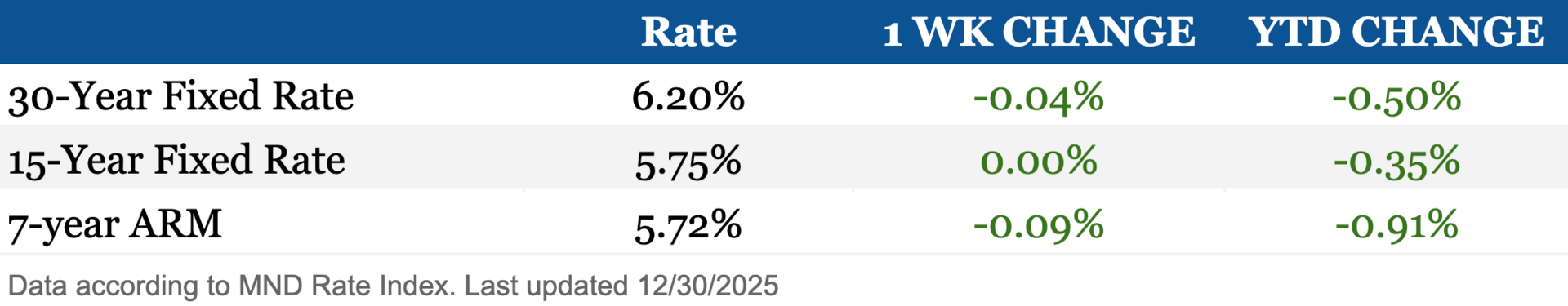

Mortgage Rate Snapshot

Mortgage rates slipped to some of their lowest levels in years during a quiet holiday week. Bigger moves are expected once full trading and major economic data return.

Regulations Update

Santa Fe, New Mexico is now pursuing criminal charges against STR owners found to be operating without proper licenses, marking a major escalation from administrative penalties to criminal prosecution.

Officials in Georgetown, Kentucky, are considering new zoning caps and strengthened licensing rules following a housing assessment that revealed 138% growth in the local rental market.

See this weeks full regulations report here: (The Host Report)