- The Host Report Newsletter

- Posts

- Vacation Rental News & Insights

Vacation Rental News & Insights

How Trump’s new housing policy proposals will affect STRs

Good morning,

Here’s what’s going on in the vacation rental world this week:

New data shows 40% of hosts are pausing expansion plans, over 900,000 Vrbo vacation rentals are now visible across Expedia’s global distribution network, and Trump is floating housing policies aimed at institutional investors and mortgage rates.

Lets dive in.

NEWS

Headline Roundup

New data shows 40% of hosts are pausing growth plans (The Host Report)

Airbnb’s chief business officer outlines new business lines, loyalty strategy, and fee changes (PhocusWire)

Expedia integrates Vrbo properties into its API (The Host Report)

‘Quiet luxury’ is becoming a dominant design trend in hospitality (The Host Report)

Guesty partners with 360 Suites to expand in Brazil’s short-term rental market (PR Newswire)

Simply Owners integrates with SuperControl (The Host Report)

WeatherPromise, a tech company providing bad-weather trip insurance, raises $12.8 million Series A (PhocusWire)

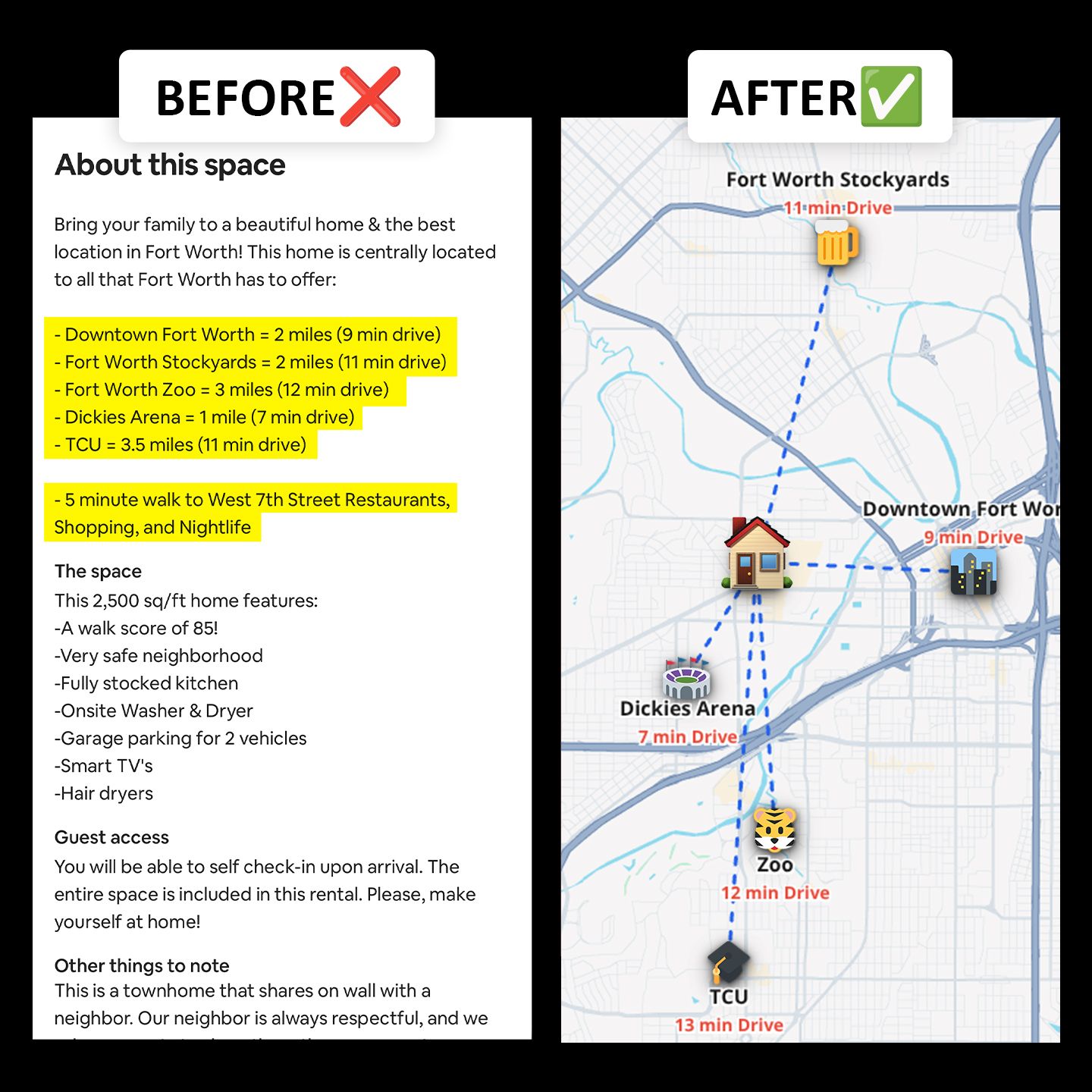

56% of travelers research things to do before they book their place to stay

So by the time they’re looking on Airbnb, the #1 thing they want to know is how close they’ll be to the action!

Thats why custom maps can boost bookings by up to 30%

65% of people are visual learners. Show (don't tell) them exactly what they’re looking for.

INTERESTING INSIGHTS

How Would Trump’s New Housing Policy Proposals Affect STRs?

Last week, President Trump made headlines floating two major housing policy ideas: banning institutional investors from buying single-family homes, and directing the purchase of $200 billion in mortgage-backed securities.

Ban on institutional investors

Trump floated a ban on “large institutional investors” purchasing single-family homes.

Who exactly would this ban apply to?

We don’t know the specifics. Trump said “institutional investors,” which is traditionally defined as groups with 1,000+ homes.

Others have used the word “corporations,” which is a very broad term that could be defined as investors who use LLCs for liability protection. Obviously, that would affect the majority of STR operators, but that broad of a definition does not seem likely. Most of the policy rhetoric is aimed at “large institutional” players, not individual investors and partnerships.

That means this proposal would likely not affect STR investors unless you own or control hundreds of homes.

The real risk for STR investors

The real risk here is a downstream effect: additional regulation. The energy created by politicians targeting “Wall Street landlords” can easily be redirected toward “Airbnb investors” at the local level as the affordability scapegoats.

If the narrative across the country becomes “investors vs. families,” local governments may feel justified to further restrict STRs under the banner of “housing affordability” (even though there’s plenty of evidence showing STRs do not impact housing affordability).

This framing is already a common justification used by cities to restrict or ban STRs today, and this political rhetoric could add fuel to that fire.

$200 billion purchase of mortgage-backed securities

Trump also sent a social media post stating that the GSEs (Fannie Mae and Freddie Mac) would purchase $200 billion of agency mortgage-backed securities to push mortgage rates lower and improve housing affordability.

Quick background: when large volumes of MBS are purchased, mortgage rates typically fall (all else equal). This is the same mechanism used during the 2008 housing crisis and again in 2020 during the pandemic.

Immediately after the post, mortgage rates priced in the news and had a significant drop where rates briefly fell below 6%.

In the short term, the expectations are this could lower mortgage rates by roughly 0.25% - 1.0%. But this policy alone is not going to return mortgage rates anywhere near pandemic-era 3% levels.

The longer-term effects are far less certain. Investors may grow cautious if they believe the government is willing to repeatedly use the GSEs as a policy tool, which could introduce new risk premiums over time.

But for STR investors, if you plan to grow your portfolio in 2026 - it does look like you’ll get a better mortgage rate than you would've gotten in 2025.

MARKET INSIGHTS

Mortgage Rate Snapshot

Mortgage rates briefly fell to below 6% after a surprise government-backed bond buying announcement. But the full decline did not hold, and by the end of the week rates moved back above 6% as volatility faded and lenders adjusted pricing.

Regulations Update

Monterey County, California, voted 3-2 to ban short-term rentals in unincorporated residential areas while allowing them in commercial zones and agricultural operations to avoid a constitutional lawsuit

Summit County, Utah, launched a dedicated STR complaint hotline and revived a regulatory subcommittee while using new licensing software to collect data that will inform potential future rules

Arizona Governor Katie Hobbs proposed a $3.50 nightly fee on short-term rentals statewide to fund the Arizona Affordability Fund for utility assistance and housing programs

Columbia, South Carolina, unanimously approved restrictions limiting new STRs to commercial and mixed-use districts or residential properties on major four-lane arterial or collector roads

See this weeks full regulations report here: (The Host Report)