- The Host Report Newsletter

- Posts

- This Week’s News & Insights

This Week’s News & Insights

How the STR strategy saves thousands in taxes while building long term wealth + The latest news & insights in the vacation rental industry

Good morning,

Here's what's going on in the vacation rental world this week:

Instagram posts from Vacation Rental pages can now show in Google searches, giving hosts a new path to direct bookings, AI booking agents are rewriting how travelers choose and book stays, and two high-end villa rental brands are expanding their STR portfolios into new markets.

On the regulations front: A Jersey Shore city will start enforcing a 3% tax on bookings through Airbnb and similar platforms, a Detroit-area suburb is banning STRs in residential neighborhoods, Kentucky’s courts have paved the way for local governments to sue Airbnb over tax collection.

Lets dive in.

NEWS

Headline Roundup

Instagram’s Google Integration Is a Game Changer for Vacation Rentals (The Host Report)

AI Agents Will Reshape How Guests Book Short-Term Rentals (The Host Report)

Airdna June 2025 U.S. Market Review: STR Supply Surges as Nightly Rates Climb (Airdna)

Case Study: How the Short-Term Rental Strategy Can Save You Thousands in Taxes While Building Long Term Wealth (The Host Report)

Vintory Tool Lets You Find Owners on Airbnb, Vrbo, and Zillow (Vintory)

Los Angeles Sues Airbnb, Alleges Price Gouging During January Wildfires (ABC7)

Short-Term Rental Income in Costa Rica to Face New 12.75% Tax Rule (The Tico Times)

Rental Escapes Adds Two Markets to Its Luxury Villa Portfolio (TravelPulse)

Villa Tracker Opens Its Ultra-Luxury Rental Platform to Travel Pros (Host Planet)

Frenchospitality Partners with Eviivo (Travolution)

Stayterra Receives a Strategic Growth Investment from Bessemer Venture Partners (Business Wire)

INTERESTING INSIGHTS

How Bonus Depreciation Turns Rentals into Tax Shields

Last week, Gabriel Virdaru, CPA, the CEO of Fortuna CPA PLLC wrote a case study on: How the Short-Term Rental Strategy Saves Thousands in Taxes While Building Long-Term Wealth

Here’s a quick summary:

A W-2 employee earning $500,000 annually, with a spouse working part-time, wanted to reduce taxes and build wealth through real estate. They didn’t own any rentals yet but aimed to eventually leave the W-2 grind. The challenge: how to reduce taxes so they keep more of their high income, allowing them to reinvest into growing their portfolio and accelerate their timeline to financial freedom.

The Unlock: Short Term Rentals

Under Reg. Sec. 1.469-1T(e)(3)(ii), a rental with an average stay of seven days or less, where the owner materially participates, is not considered passive. This allows rental losses to offset W-2 income without qualifying as a real estate professional.

Material Participation: Clearing the Hurdle

The easiest material participation test for the couple was the 100-hour test. Hours came from setting up the property (furnishing, decorating, stocking supplies, and creating the listing) plus guest communication, cleanings, repairs, and inspections. Time spent learning or traveling typically doesn’t count, but spouses can combine hours, making the 100-hour threshold very achievable. By taking a few hands-on weekend trips to prep the property, they easily satisfied the test and unlocked the tax benefits.

How It Pays Off

With 100% bonus depreciation reinstated under the One Big Beautiful Bill, the tax impact was substantial. A cost segregation study typically reclassifies 20%–30% of a property’s basis into bonus-eligible assets; this case yielded 25%.

Purchase price: $750,000

Land (non-depreciable, 20%): $150,000

Depreciable building basis: $600,000

Reclassified as bonus-eligible (25%): $150,000

Marginal tax bracket (married, joint filing): 32%

The $150,000 deduction generated roughly $48,000 in federal tax savings in year one. Additional deductible expenses (mortgage interest, property taxes, insurance, utilities, and supplies) also increased the overall reported loss and tax benefit.

By using the STR strategy, this couple turned a single property into a $48,000+ tax savings vehicle while building equity and cash flow, accelerating their path to financial freedom.

MARKET INSIGHTS

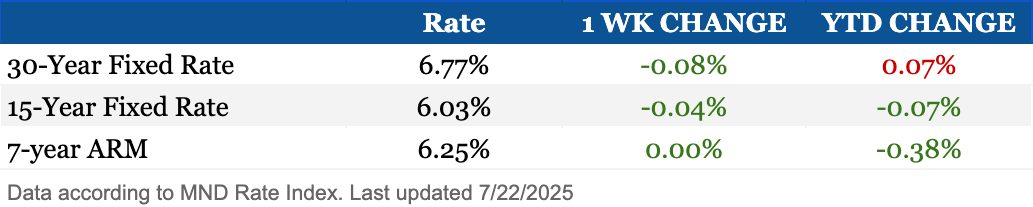

Mortgage Rate Snapshot

Mortgage rates stayed largely stable over the past week, briefly facing upward pressure from rumors about Trump firing Fed Chair Powell before reversing course. By the end of the stretch, the average 30-year fixed rate was down about 0.08%, hitting its lowest level since early July.

Regulations Update

Dearborn, Michigan, has banned short-term rentals in residential zones and single-family homes effective January 1, 2026, restricting them only to downtown districts with mandatory licensing

Ocean City, New Jersey, introduced a 3% tax on short-term rentals booked through third-party platforms like Airbnb, effective in 90 days

Kentucky's Court of Appeals upheld a ruling allowing lawsuits against Airbnb to enforce transient room tax collection, potentially increasing compliance costs statewide

Londonderry, Vermont, implemented a 50-night annual cap for non-primary residences with a one-year waiting period for new registrations and mandatory quiet hours enforcement

Kennesaw, Georgia, passed an ordinance limiting STRs to single-family residential zones with 250-foot buffers between rentals, capping licenses at 150, and charging $250 application fees

Westerly, Rhode Island, raised annual registration fees from $50 to $500 to fund a new tracking system, with potential caps on STR numbers under consideration

Athens, Greece, extended the mandatory short-term rental registration deadline to July 21, with potential new permit restrictions in high-demand areas

Ocean City, Maryland, residents voted on July 22 to potentially overturn a council ordinance imposing 5-night minimum stays that increase to 31 days by 2027

Milton, Delaware, is reviewing new restrictions on short-term rentals following recent licensing rules, with the town council considering further zoning limits

See this weeks full regulations report here: (The Host Report)